There are also other available choices nowadays, such interest-only lenders and you can line of credit mortgage brokers. Although not, while an initial household visitors, speaking of perhaps the three choice you will be organizing up ranging from.

How to get a mortgage

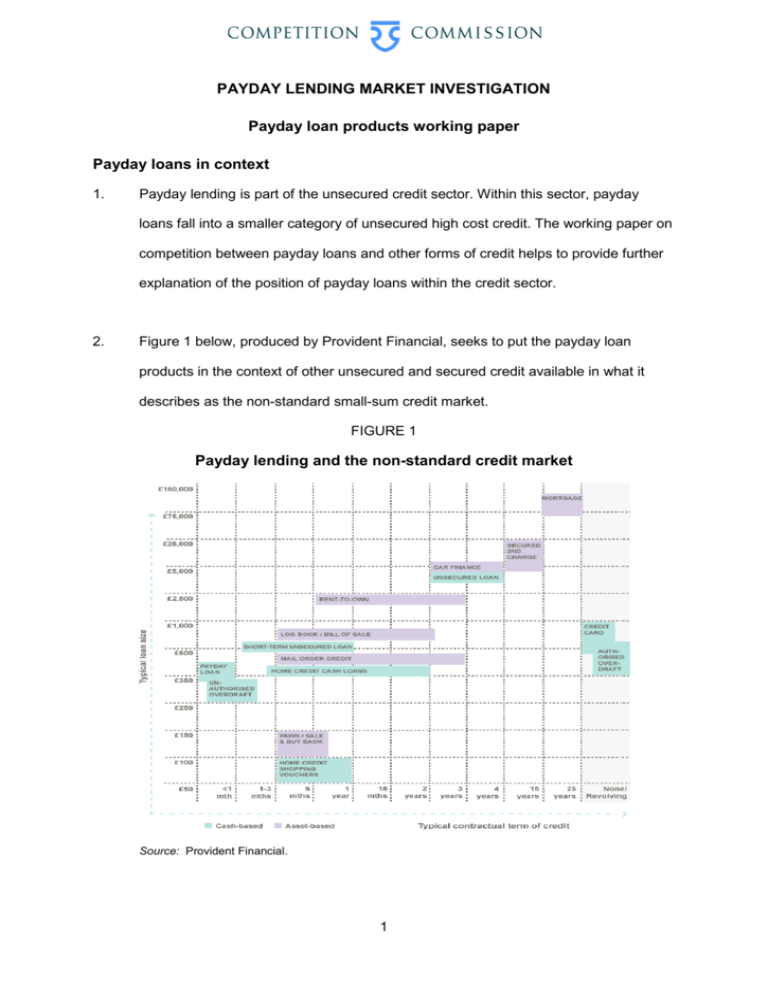

Love to view a video clip? Discover how Rateseeker helps you support the sharpest financial price within explainer films.

1. Conserve getting a deposit

Earliest one thing basic: before getting a home loan, you ought to have a deposit, that’s a percentage of full purchase price youre considering giving. For the majority of Aussies, the entire guideline is always to save your self in initial deposit from around 20%, if you wish to end using loan providers financial insurance.

When you is also commercially get approved to possess a mortgage with only 5%, loan providers you will view you just like the riskier and may enjoys more restrictions and also make your application more complicated getting acknowledged including appearing that you have legitimate offers -even with expenses Loan providers Financial Insurance rates (LMI). It is because the loan insurance carrier (Genworth otherwise QBE) may also have so you can accept your residence application for the loan.

2. Look other financial prices

While we mentioned earlier, even a seemingly unimportant count on your own mortgage interest can add up over the years.

Example: What if you have a home loan off $three hundred,000 over a 25-seasons mortgage name. Let me reveal a look at just how your repayments perform sound right more time:

Professional idea: While it is easy to visit your own nearby lender, understand that they will not will have the sharpest notice rates online. The easiest way to research all the various home loan costs is by using a home loan rates testing platform such as for instance Rateseeker. By doing this, you might evaluate various other cost from over 31+ lenders and acquire one which gives you the best price on the loan.

step three. Secure pre-acceptance

After you’ve a sense of the home loan you’re shortly after, the next phase is to obtain pre-recognized to suit your mortgage. So it area actually mandatory and never every lenders give it. Although not, if you possibly could score pre-approval, it gets your to acquire in a position and supply the depend on and make an offer towards a good assets.

Pre-approval gives you a rough thought of simply how much you could potentially obtain, based on their put, credit rating and several financial guidance. it strengthens your own bargaining stamina while you are to make a deal to your a property. In case your seller understands that you may be pre-acknowledged, you’ll be named a popular visitors – which comes in the handy if there is solid competition to own a property.

Lots of loan providers (such as the biggest banking companies) enables you to complete the pre-approval techniques on the internet. The complete techniques you are able to do within just period otherwise a few days. Yet not, bear in mind that you might still need certainly to visit an excellent branch to possess an out in-individual appointment.

Now you is to purchase ready’ and discovered forget the otherwise forever home’, you’ll need to score unconditional recognition out of your financial to move submit.

After you have generated a deal, the bank will demand you to definitely offer an agreement out-of business. They upcoming make a great valuation of the home and you may, in the event the accepted, draft the mortgage documents. Should this be all the all set, you’re getting the loan data files and you may package. These types of might be assessed by the solicitor otherwise conveyancer, up coming closed by you and the seller.

six. Planning settlement

Here is the last area of the financial process: payment. That is where the vendor officially payday loans transfers the house to you personally, therefore get the latest keys to your brand-new domestic. Furthermore whether your loan kicks on the impression, and you are clearly required to finalise and you can pay money for most of the relevant will cost you that is included with to get a house (such stamp duty).